PAN card update/Correction can be done using both online and offline methods. A Permanent Account Number (PAN) card is essential for tax filings and is a vital identity proof. It is advisable to update the PAN card and correct any inaccuracies or changes in details like name, date of birth, Photo, signature, contact information, or other personal data should be corrected promptly to avoid complications and ensure smooth financial transactions. It is also important to link your PAN card with your Aadhar card.

In this, we are Learning more about how to make PAN card corrections online and offline, applicable fees, required documents, and more.

Reasons to Change PAN Card Details

Mistakes in your name, parent’s name, or date of birth can occur on your PAN card. Additionally, changes in address or name may happen after the card is issued.

Individuals may need to correct their name on their PAN card due to legal name changes, misspellings, or due to surname changes after marriage.

PAN Card Correction/ Update Form Download

You can download the PDF of the PAN card correction form below.

click here to download the form

How to update PAN card online?

You can update PAN card details online through the NSDL e-Gov website or the UTIITSL website. If you’ve applied for a PAN card through the NSDL e-Gov website, you must update your PAN card details via the same website. Similarly, if your PAN card application was through the UTIITSL website, update details there.

How to update PAN card on the NSDL e-Gov portal?

The step-by-step guide to making PAN card corrections online is as follows:

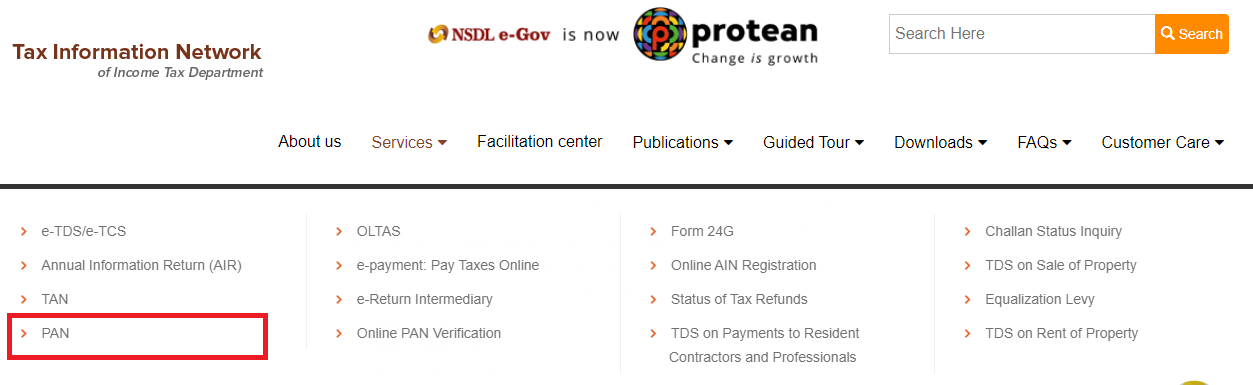

1: Visit the NSDL e-Gov portal.

2: Click on the ‘Services’ tab and select ‘PAN’ from the dropdown menu.

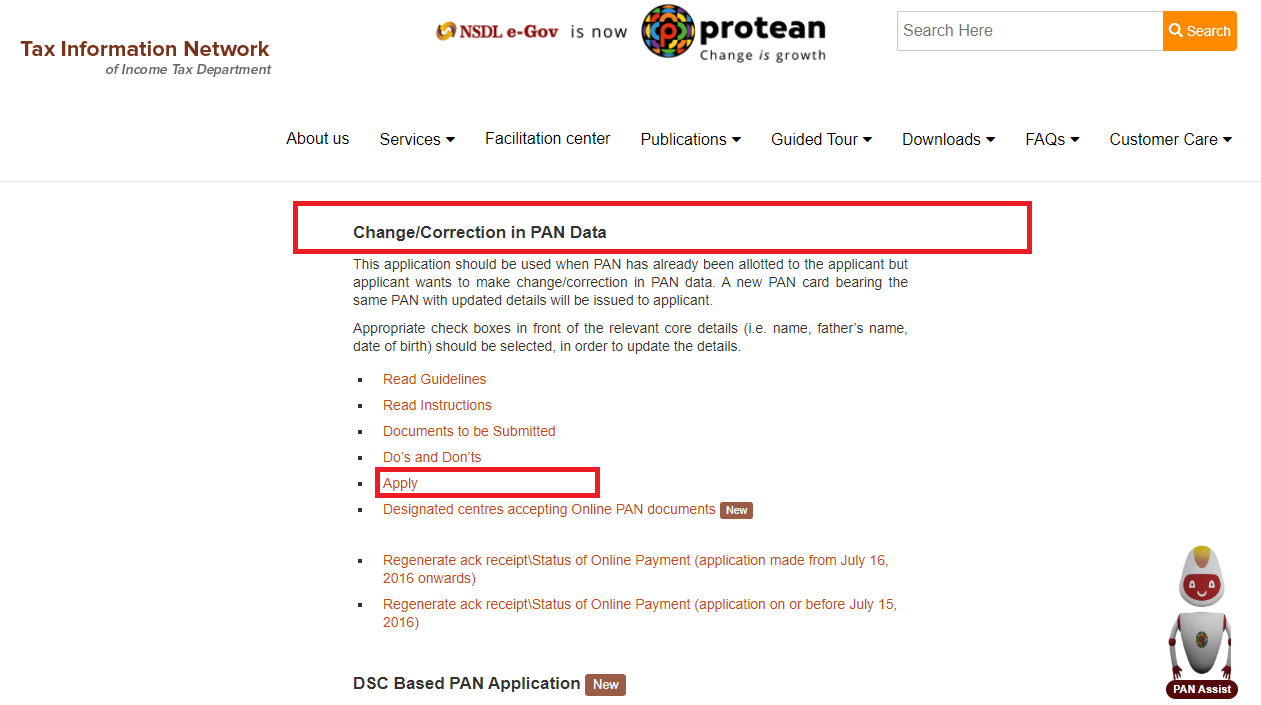

3: Now scroll down and find the heading ‘Change/Correction in PAN Data’. Click on ‘Apply’ as shown below.

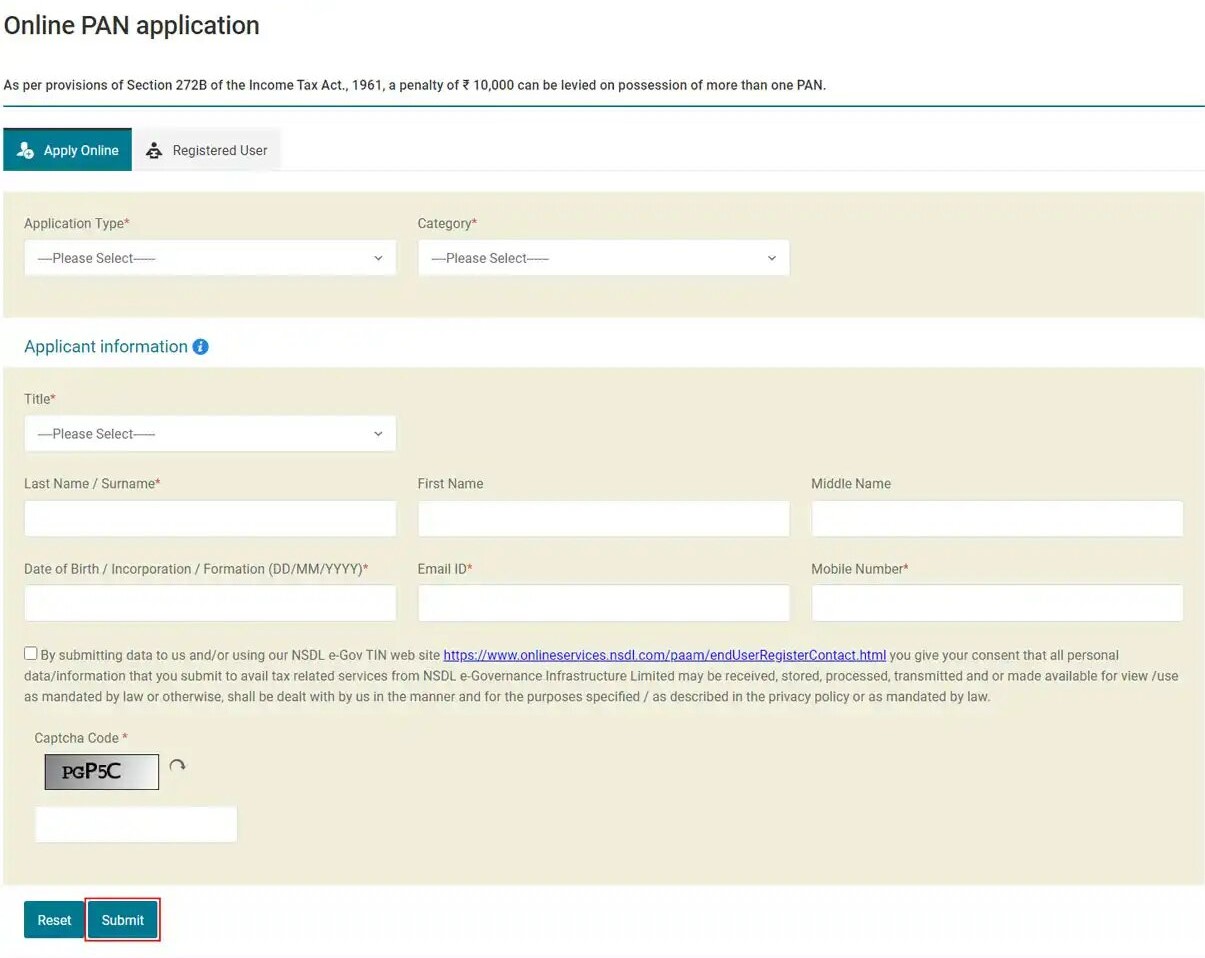

4: Now, you must fill out this Online PAN Application which requires details like Application type, Category, and your details. Type in ‘Captcha Code’ and tap on ‘Submit’.

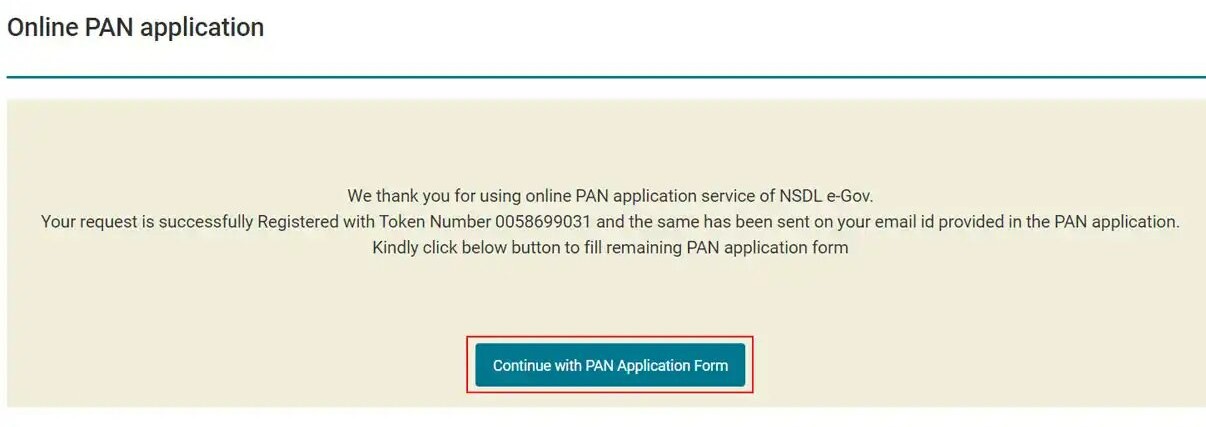

5. Now, click on ‘Continue with PAN Application Form’.

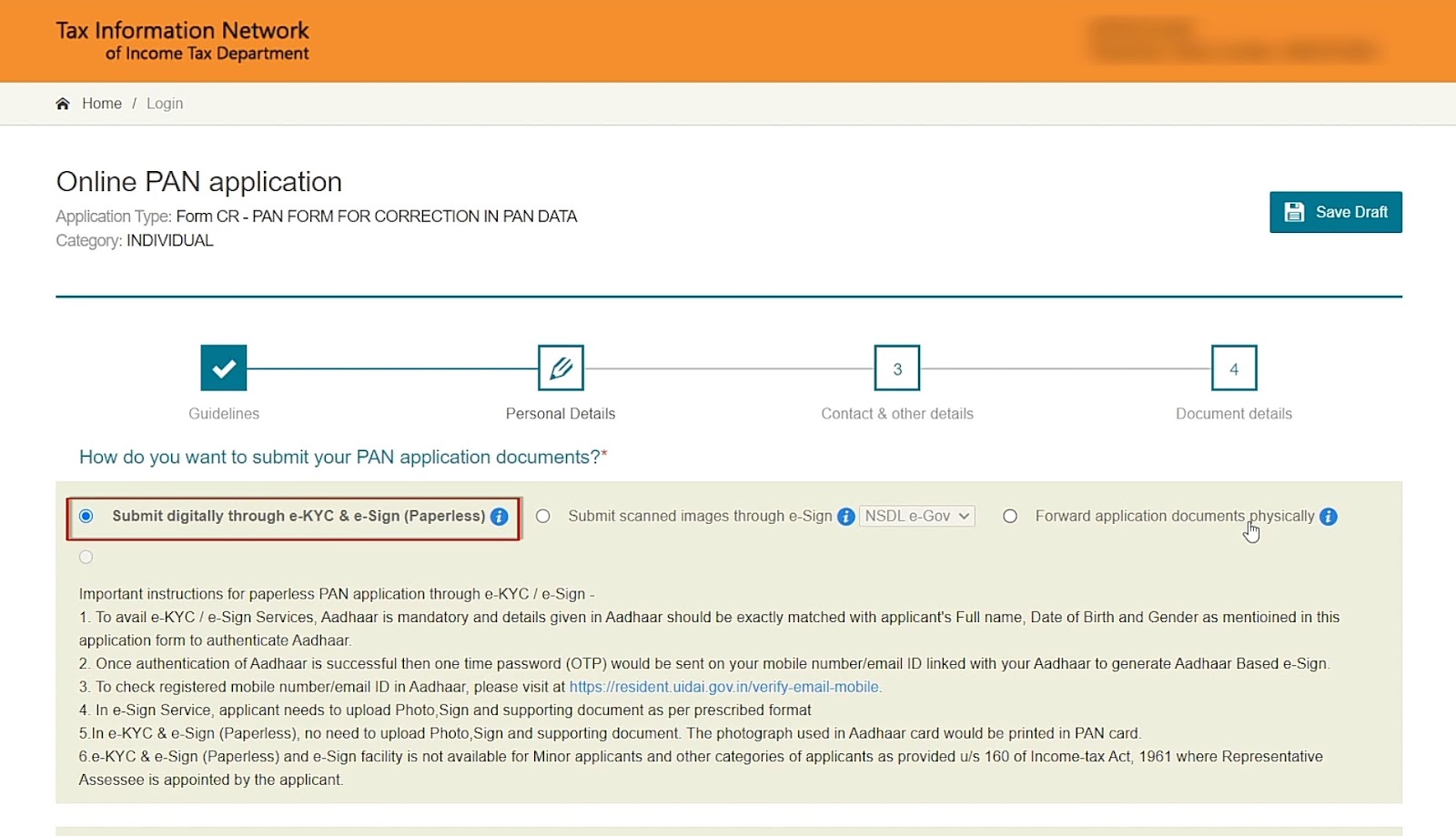

6: Out of three options select “Submit digitally through e-KYC & e-Sign (Paperless)” to complete the entire process online through Aadhaar OTP.

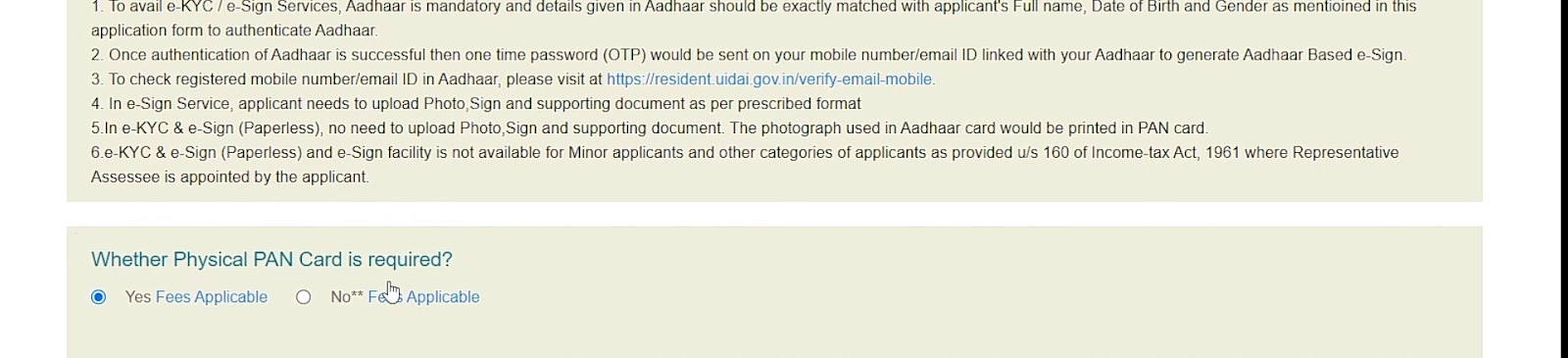

7: On the next page, If you need a new physical copy of the updated PAN card, select “yes nominal fees”.

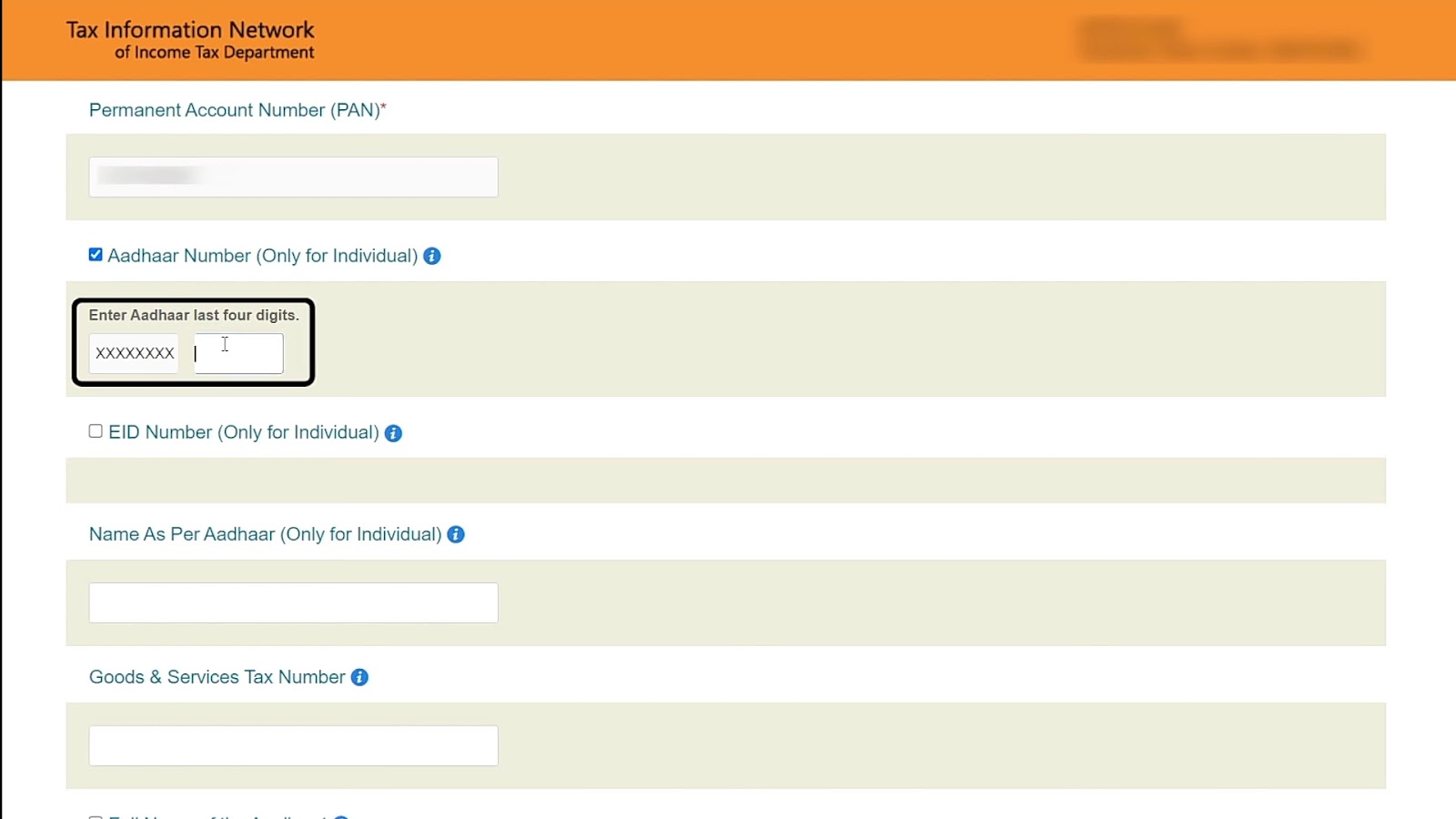

8: Scroll down and fill in the last four digits of your Aadhaar number.

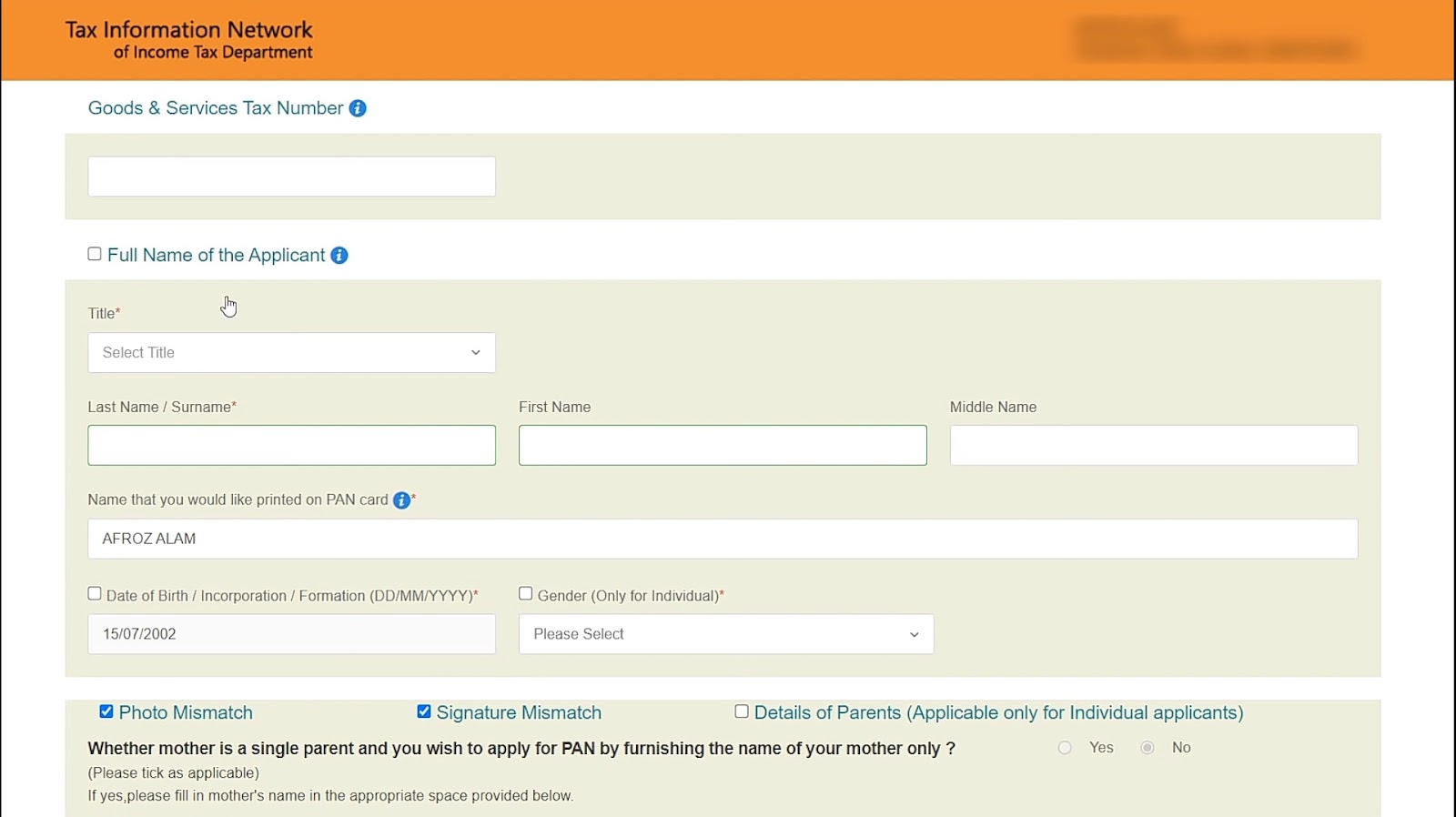

9: Scroll down and update the required details. Tick the box for which correction or update is needed. Now, click on ‘Next’.

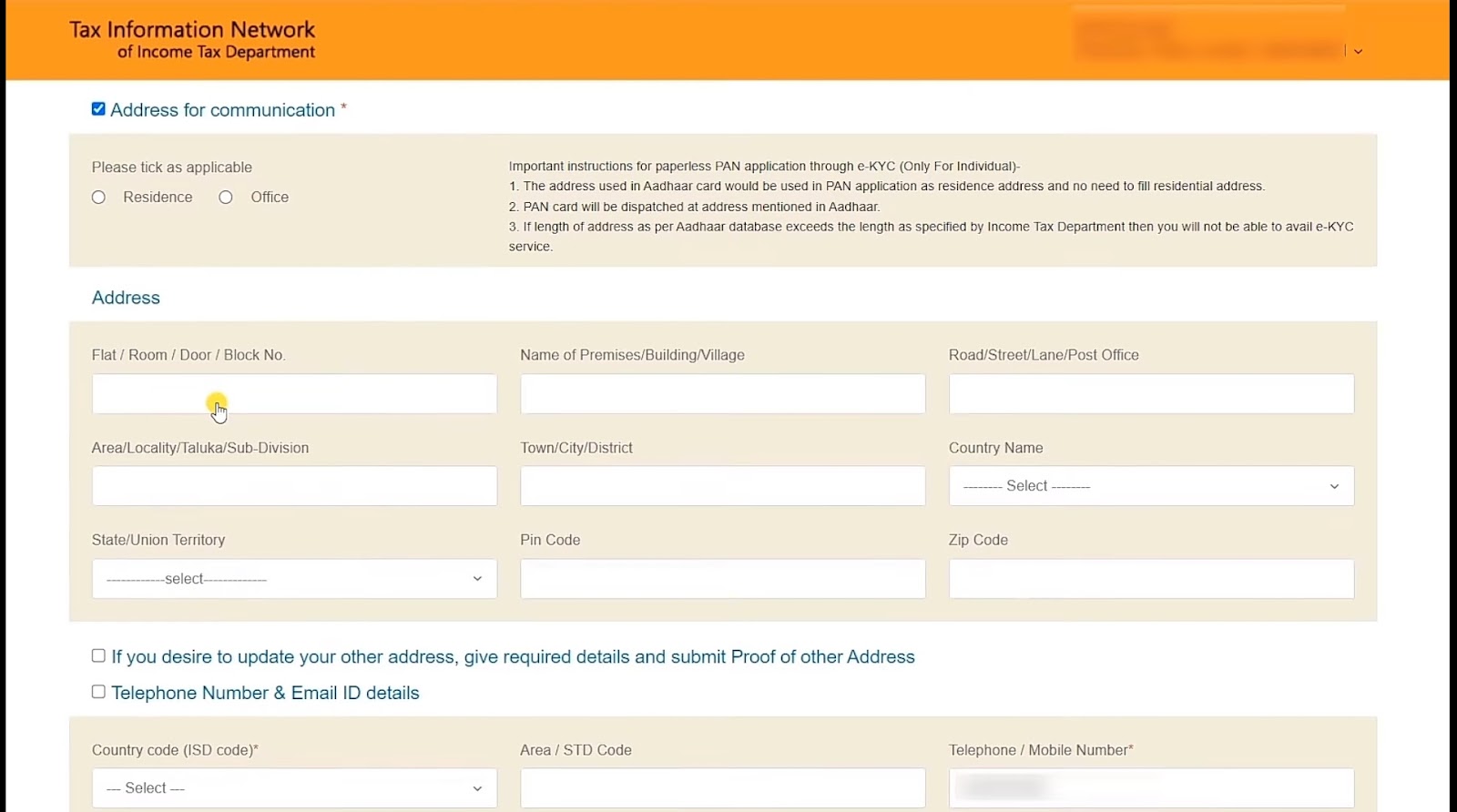

10: On this page, enter the new address, required mobile number, or email, and proceed to the next page.

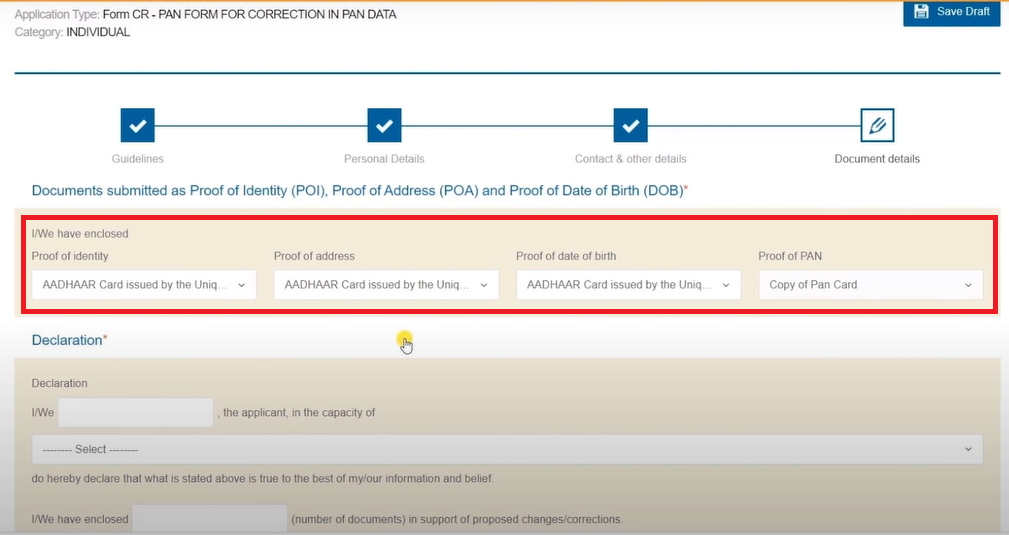

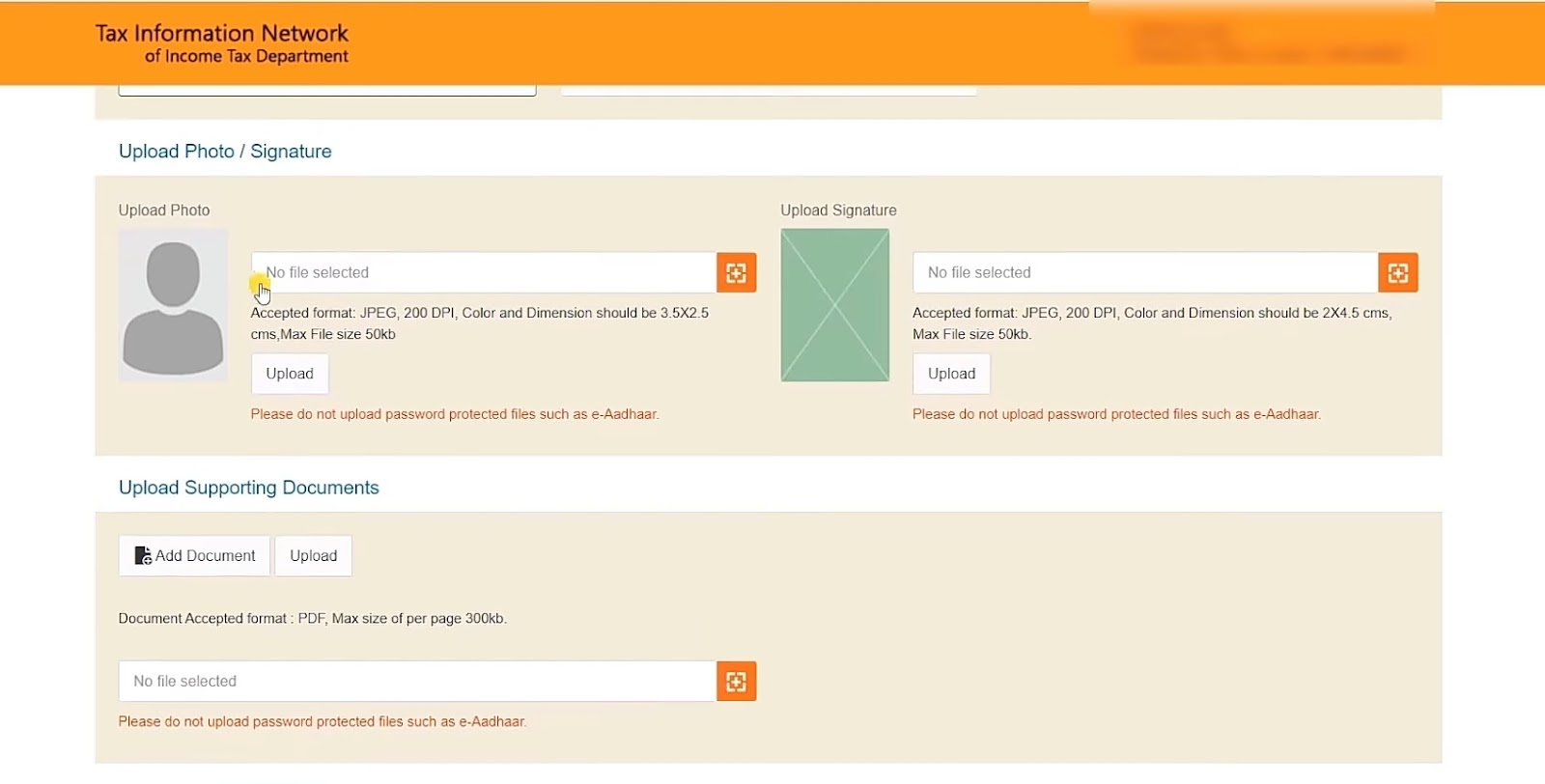

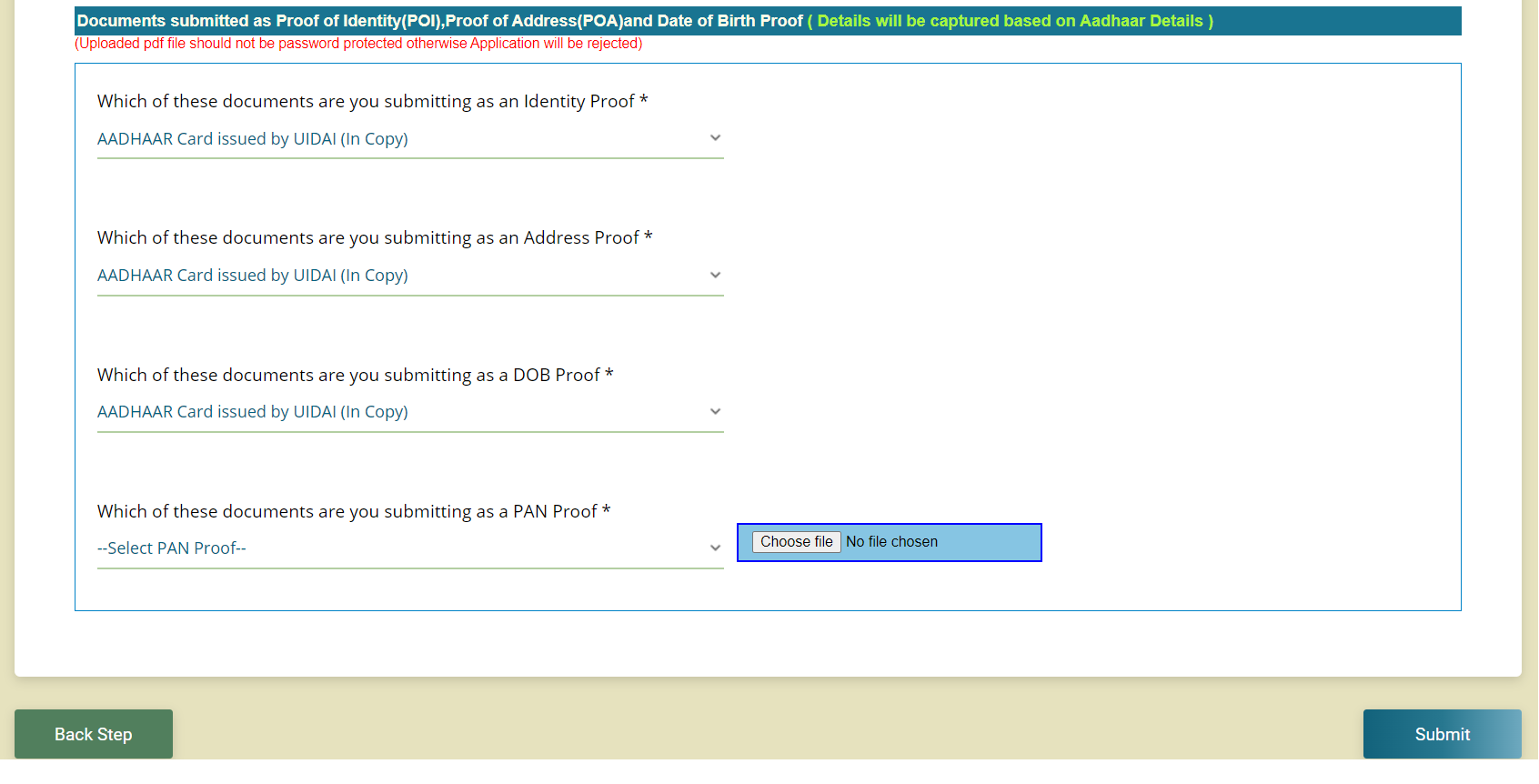

11: On this page, attach the proof document (for which changes are required) with a copy of PAN.

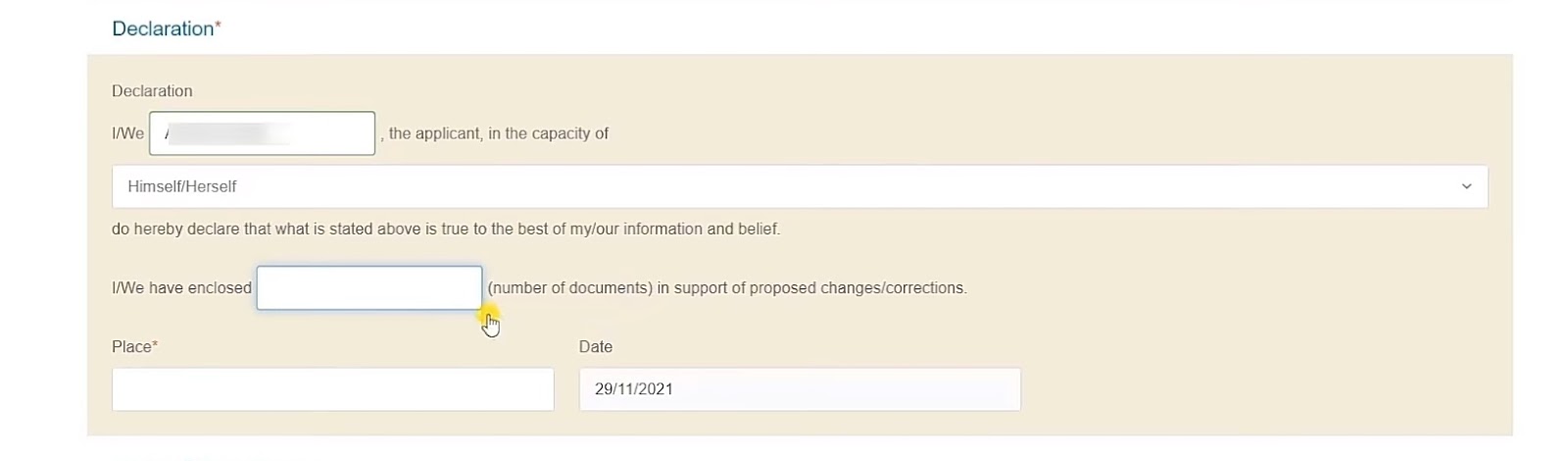

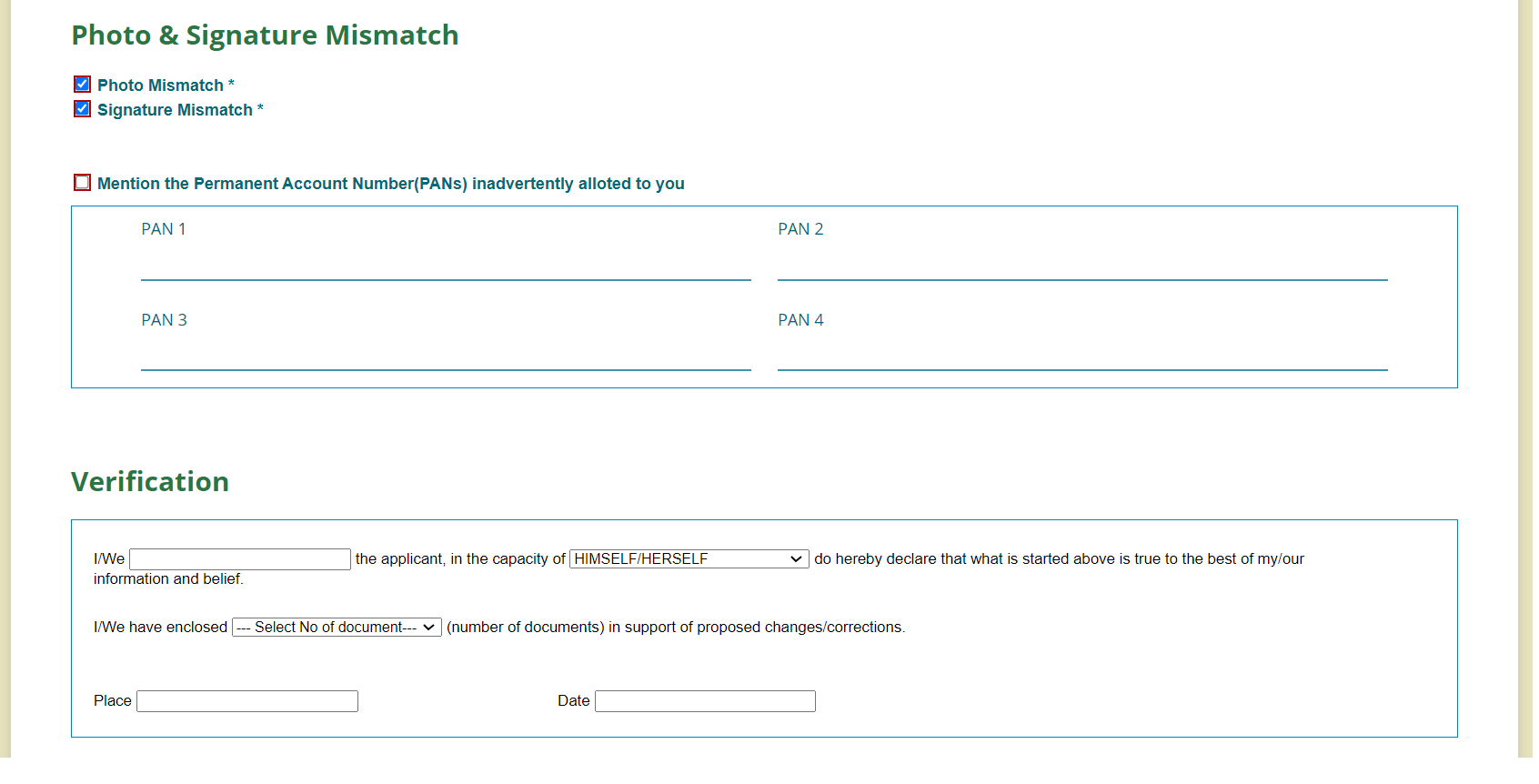

12: Mention your name, Enter your place of residence, and ‘Himself/herself’ in the declaration section.

13: Attach a copy of your ‘photograph’ and ‘signature’ in specifications size and limit. Then, click ‘Submit’.

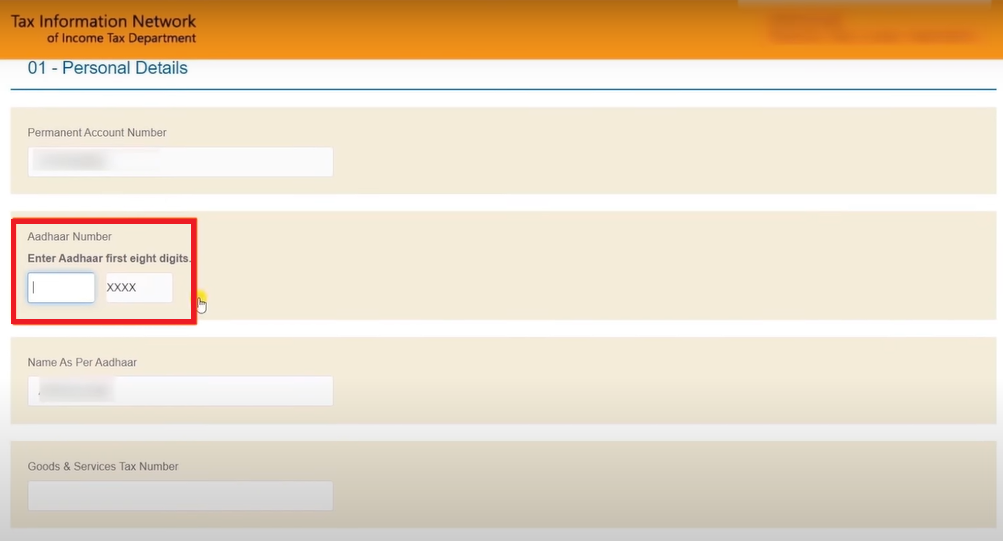

14: Now preview of the form will be displayed. Please ensure all the filled details are correct then enter the first 8 digits of your Aadhar card.

15: After submitting, the payment page will appear. After successful payment, you will receive a payment receipt.

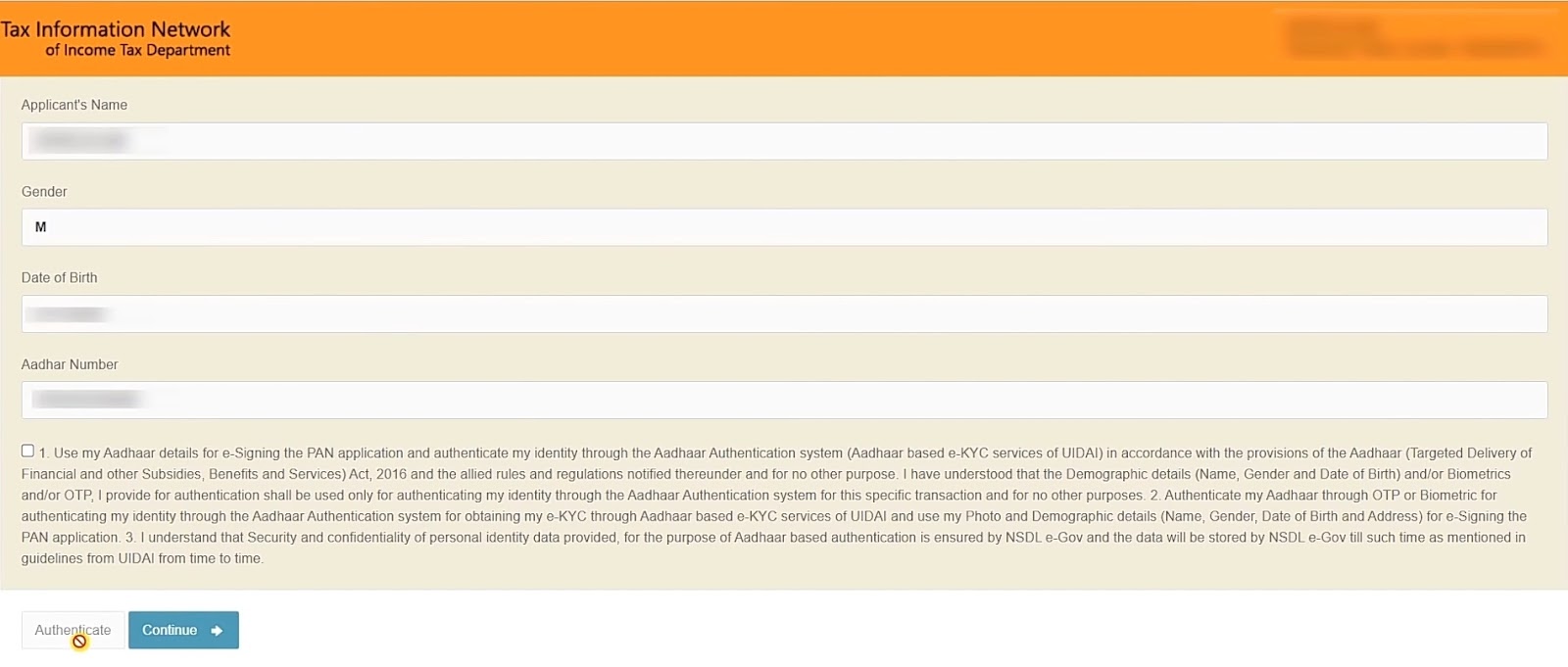

16: After successful payment, a new page will appear. To complete the PAN card update process, click ‘continue’. You will now have to complete the KYC process. Select the check box to accept the terms and conditions and click on ‘Authenticate’.

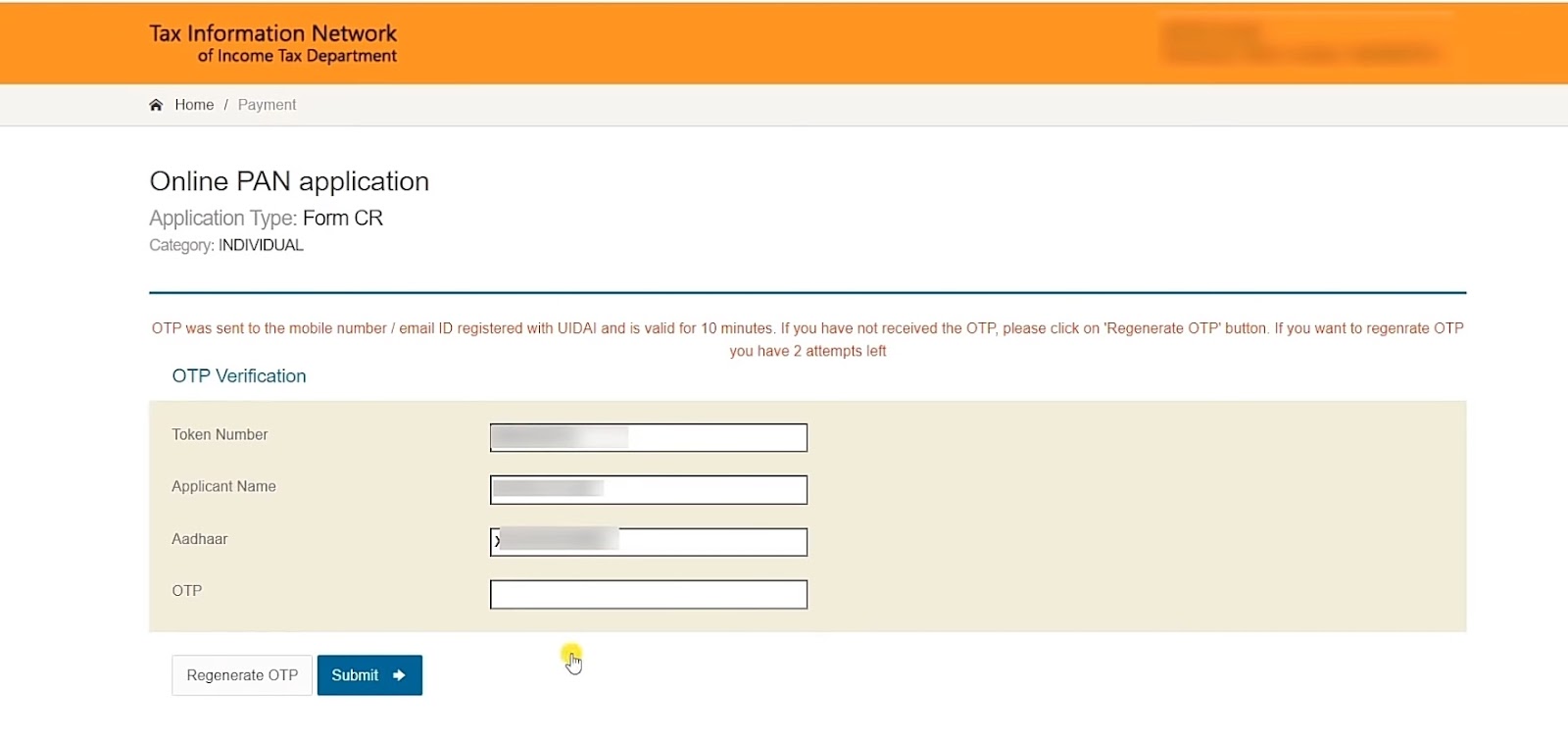

17: OTP will be received on your Aadhaar-registered mobile number. Enter the OTP and clock on “submit”.

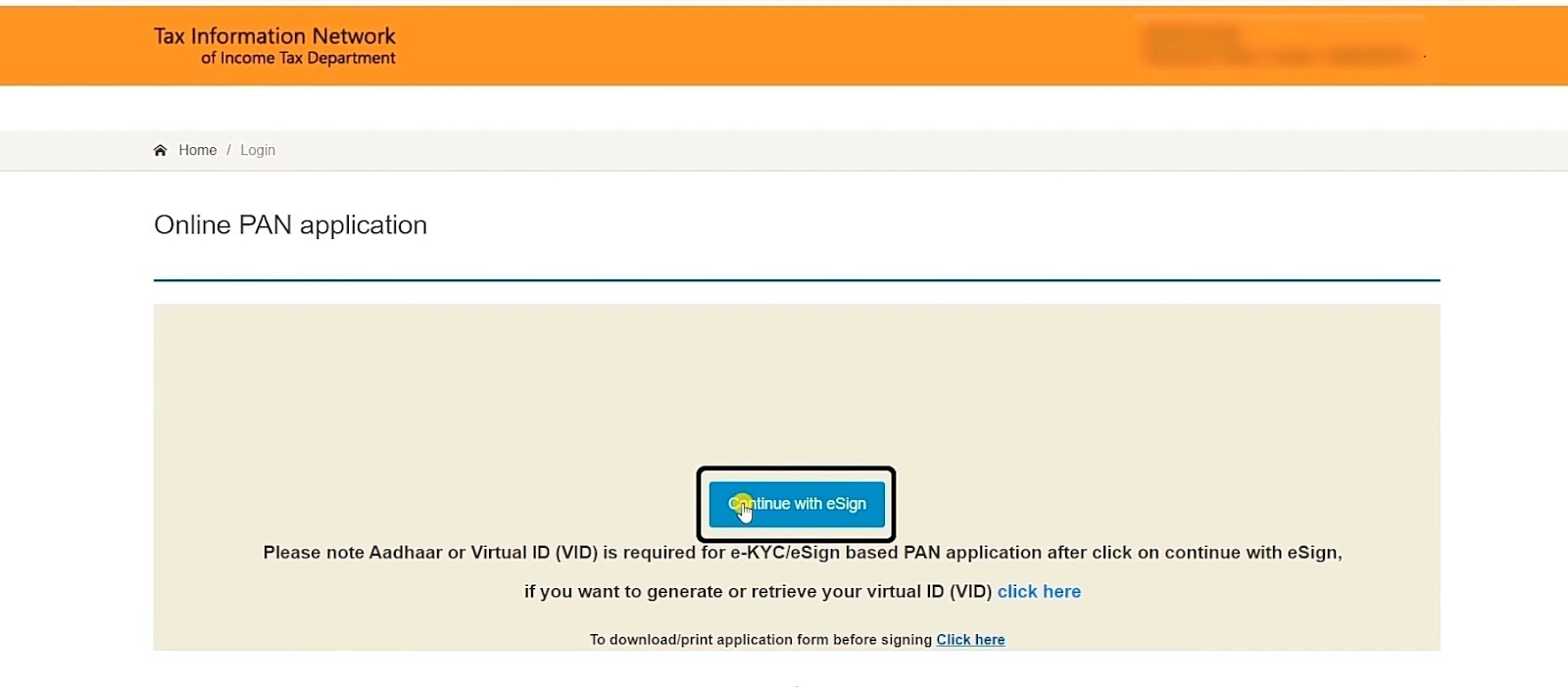

18: On the next page, click “continue with eSign”.

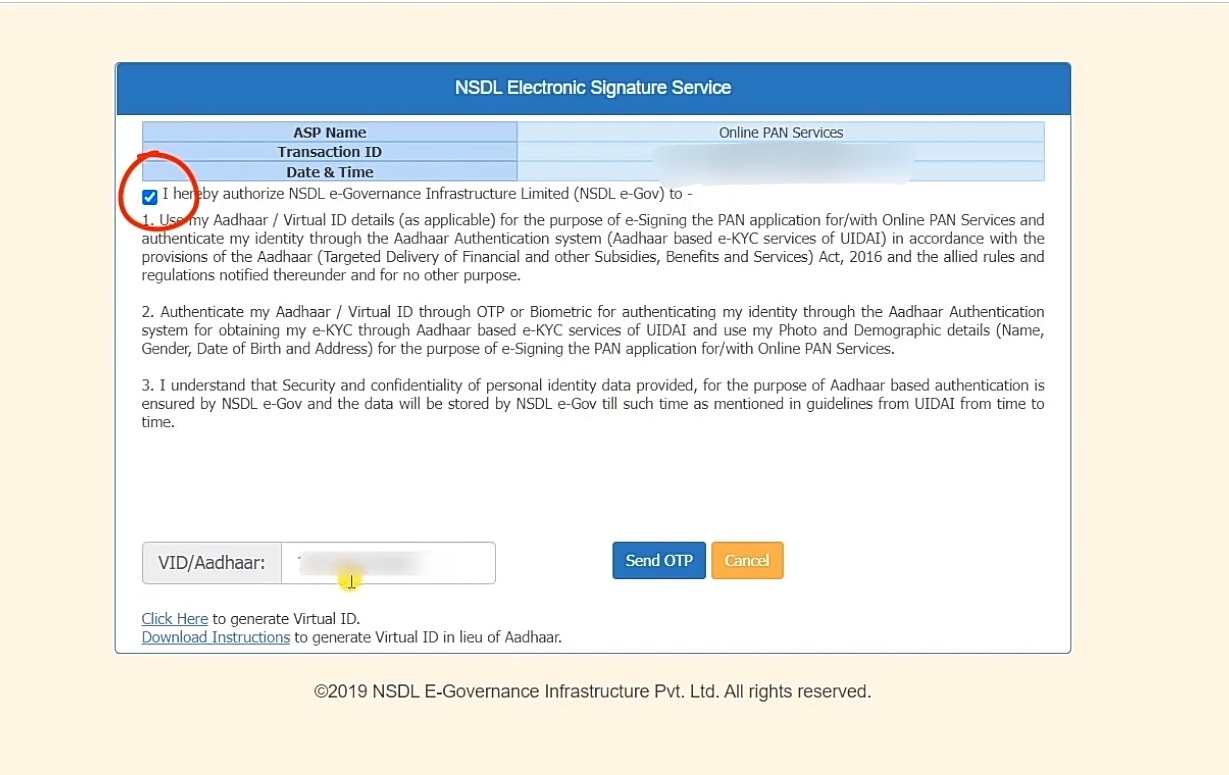

19: Accept the terms and conditions by ticking the box. Fill in your Aadhaar number and click “Send OTP”.

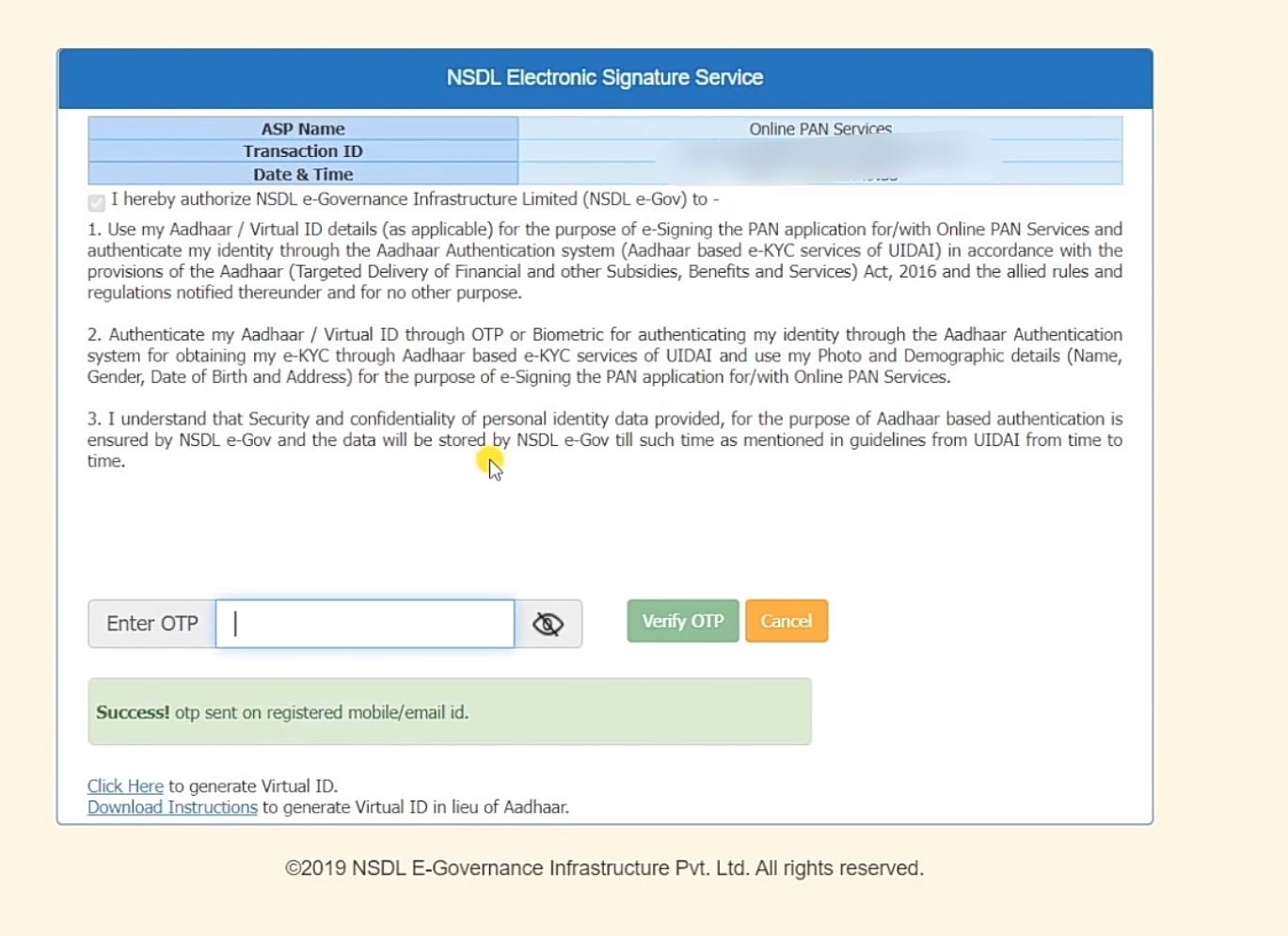

20: Enter the OTP received to your Aadhaar Registered mobile number and click “Verify OTP”.

21. You can now download the acknowledgment form. The password to open this file is your date of birth in the format DD/MM/YYYY.

If, you opted for the ‘Forward application documents physically’ in Step 6. You must post acknowledgment and required documents to the following address by post.

income Tax PAN Services Unit,

Protean eGov Technologies Limited,

4th Floor, Sapphire Chambers,

Baner Road, Baner, Pune – 411045

How to update PAN card on the UTIITSL portal?

The step-by-step guide to making PAN card corrections online is as follows:

1: Visit the UTIITSL website.

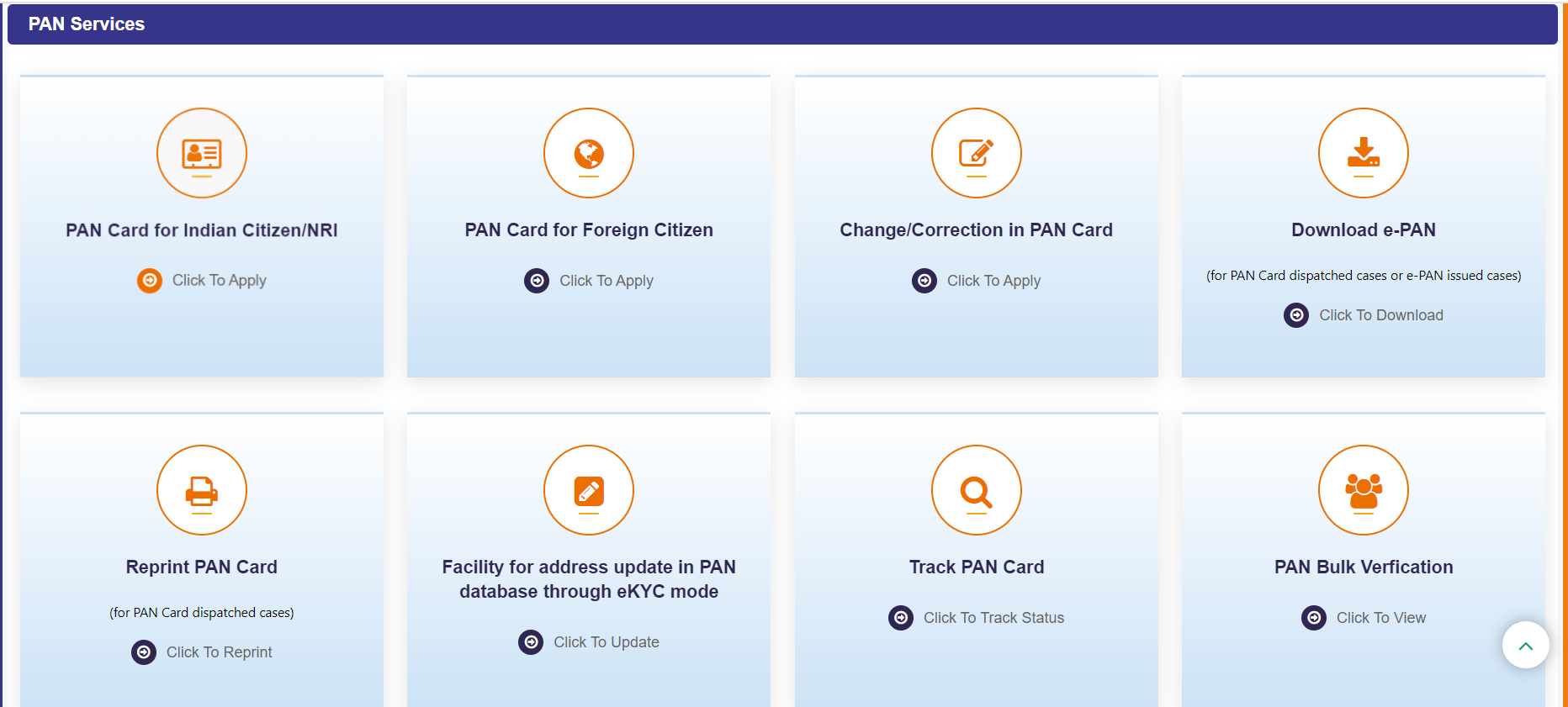

2: Click on “Click to Apply” under the “Change/Correction in PAN Card” icon.

3: On the next page, Click on “Apply for Change/Correction in PAN card details” icon.

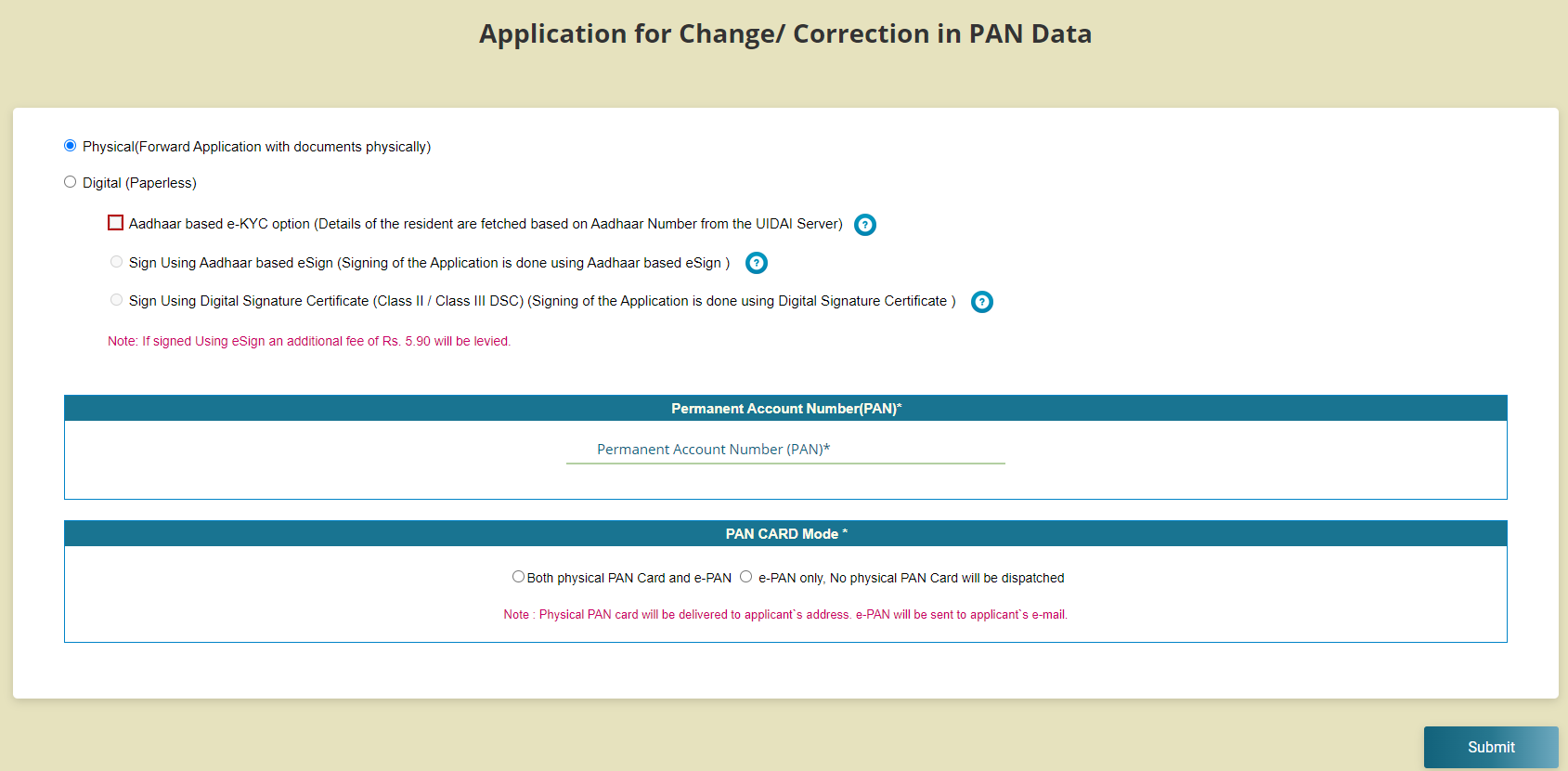

4: Select the mode of submission of documents (select Aadhar based e-KYC option), enter your PAN number, select the PAN card mode, and click the “Submit” button.

5: If the request is registered, you will receive a reference number. Click on ‘OK’.

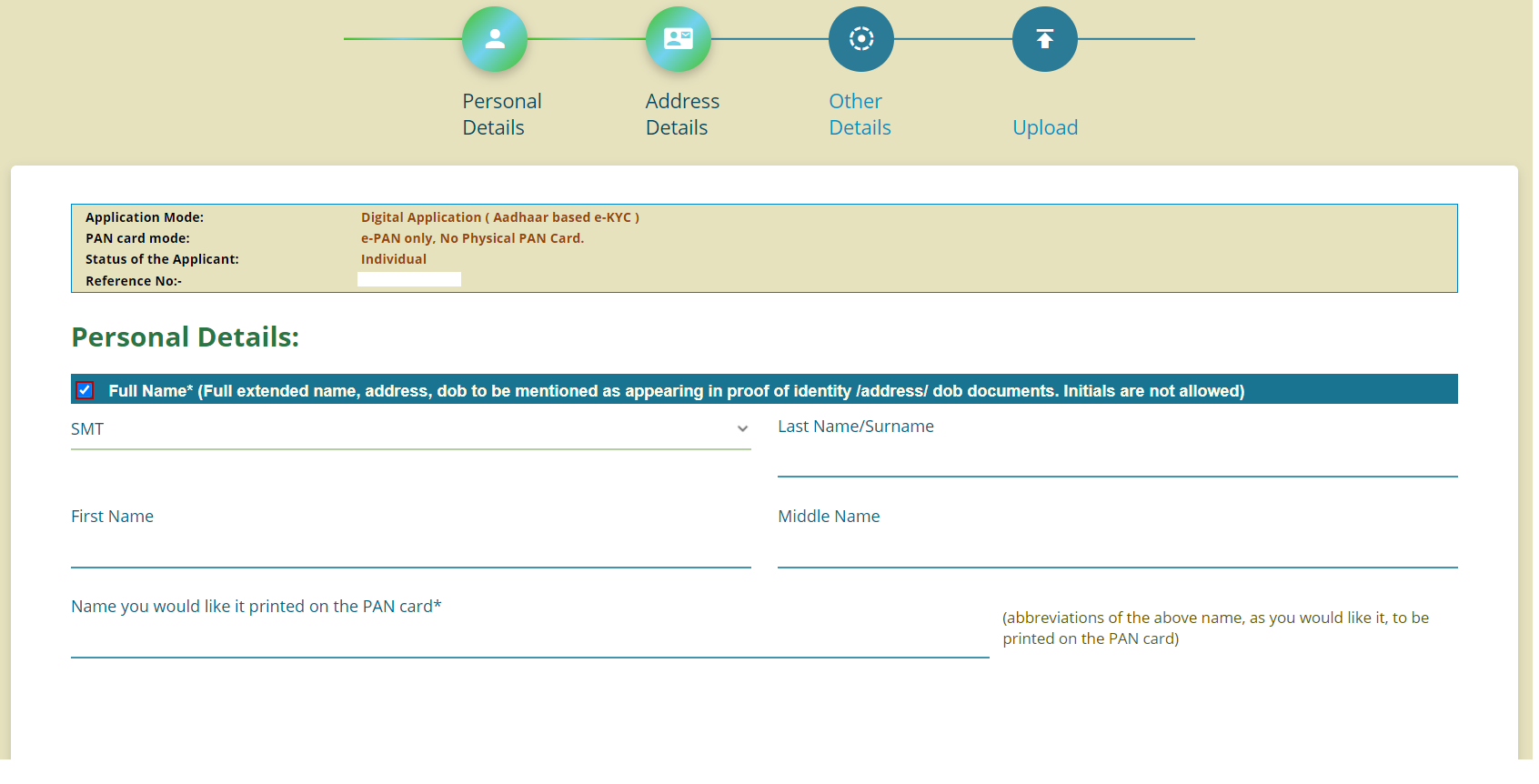

6: Tick the fields that requires to be updated or corrected. Enter the updated or correct personal details. Click on ‘Next Step’ once the details are entered.

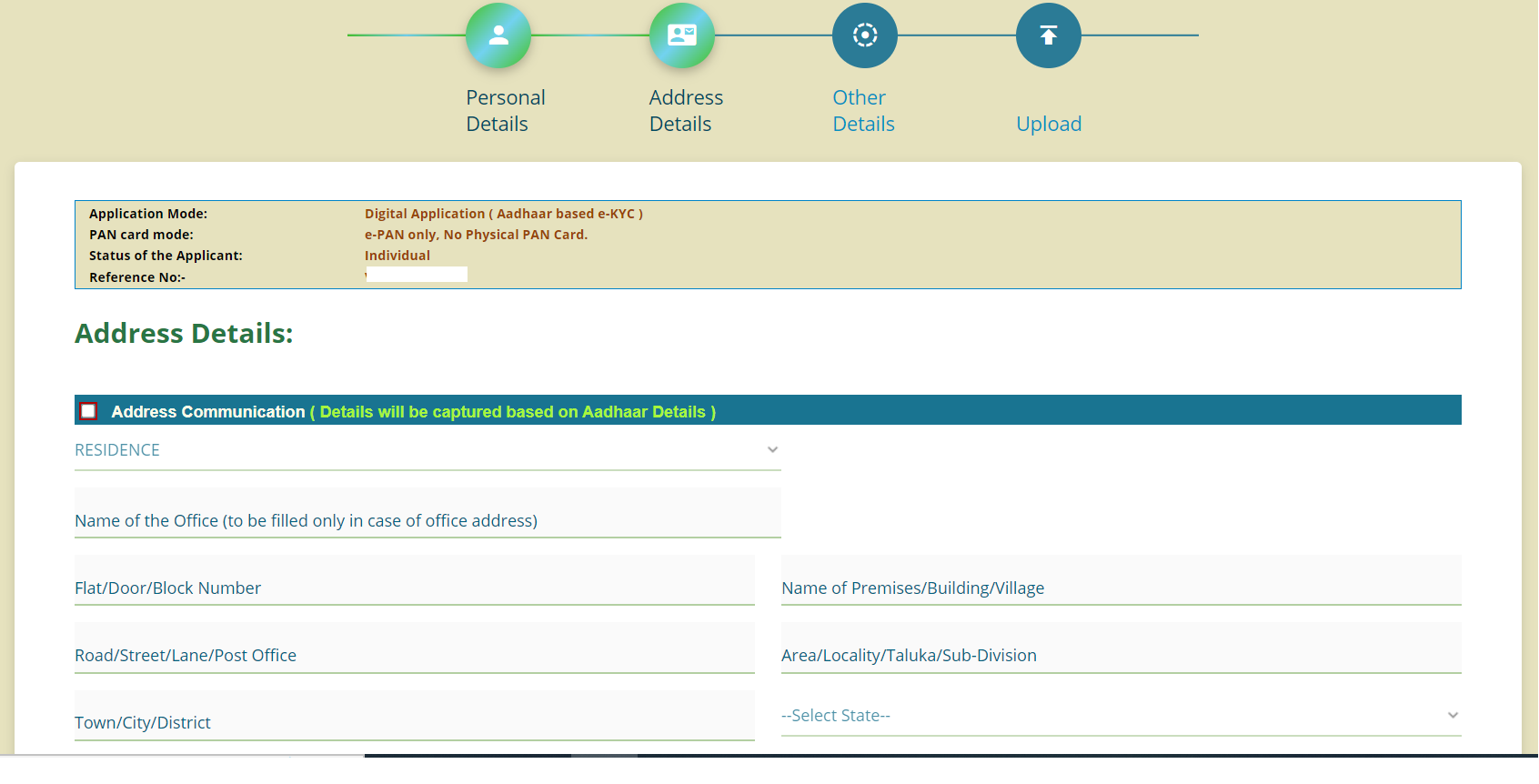

7: The address will be updated as per your Aadhaar card. Enter your contact details and click on ‘Next Step’.

8: Enter the PAN number and verification and click the ‘Next Step’ button.

9: Upload the documents and click the ‘Submit’ button.

10: Verify the details and click on “Make Payment” button.

11: Select the mode of online payment and make the payment. A success message will be displayed once the payment is successfully made. Take a printout of the form.

If, you opted for the ‘Forward application documents physically’ in Step 4. You will have to take a printout of the form, affix a photograph and signature, attach the documents to the form, and post them to any one of the following nearest UTIITSL offices.

| 1) PAN PDC Incharge – Mumbai region UTI Infrastructure Technology And Services Limited Plot No. 3, Sector 11, CBD Belapur, Navi Mumbai – 400614 |

2) PAN PDC Incharge – Kolkata region UTI Infrastructure Technology And Services Limited 29, N. S. Road, Ground Floor, Opp. Gilander House and Standard Chartered Bank, Kolkata – 700001 |

| 3) PAN PDC Incharge – Chennai region UTI Infrastructure Technology And Services Limited D-1, First Floor, Thiru -Vi-Ka Industrial Estate, Guindy, Chennai – 600032 |

4) PAN PDC Incharge – New Delhi region UTI Infrastructure Technology And Services Limited 1/28 Sunlight Building, Asaf Ali Road, New Delhi -110002 |

How to update PAN Card offline?

You can update and correct PAN Card in offline mode as well. please remember below points:

- Download the PAN card Correction Form from the official website.

- Fill in the required details and tick the box on the left margin for the information you want to change.

- Submit the filled form and documents to your nearest Protean center. Find your center here.

- Once confirmed, a 15-digit acknowledgment number and acknowledgment slip will be provided at the center.

- You will need to send this slip to the Income Tax PAN Service Unit of the NSDL within 15 days.

Documents Required for PAN Card Correction

The required documents can vary based on the type of applicant.

Indian Citizens and HUF

- Identity Proof: Aadhaar card, Voter ID, Driving license, Passport, etc.

- Address Proof: Aadhaar card, Voter ID, Driving license, Passport, etc.

- Date of Birth Proof: Aadhaar card, Voter ID, Driving license, Passport, etc.

Foreign Citizens

- Identity Proof: Passport, PIO card, OCI card, etc.

- Address Proof: NRE bank account statement, Certificate of Residence in India, etc.

Indian Companies

- Copy of registration certificate issued by Registrar of Companies (ROC) (for company)

- Certificate of registration or partnership deed (for partnership firms)

- Certificate of registration issued by the Registrar of LLPs (for LLPs)

- Trust deed and certificate of registration number (for Trusts)

- Agreement copy and certificate of registration number (for others)

Companies with a Registered Office Outside India

- Taxpayer identification number attested by Apostille

- Registration certificate issued in India or approval granted by Indian authorities

Who Needs to Sign the PAN Card Correction Application?

- Company: Director’s signature

- HUF: Karta’s signature

- Trust: Trustee’s signature

- Minor: Representative assessee’s signature

- Individual or Partnership Firm/LLP: Applicant’s signature

- Local authority, artificial juridical person, AOP, BOI: Authorized signatory’s signature

- Individual applicant

Fees for PAN Card Update or Correction

The PAN card updation fees for online application submission are as follows:

| Mode of submission of PAN application documents | Particulars | Fees (inclusive of applicable taxes) |

| PAN application submitted using physical mode for physical dispatch of PAN card | Dispatch of physical PAN card in India | 107 |

| Dispatch of physical PAN card outside India | 1,017 | |

| PAN application submitted through paperless modes for physical dispatch of PAN card | Dispatch of physical PAN card in India | 101 |

| Dispatch of physical PAN card outside India | 1,011 | |

| PAN application submitted using physical mode for e-PAN card | e-PAN card dispatched at the email ID of the applicant | 72 |

| PAN application submitted through paperless modes for e-PAN card | e-PAN card dispatched at the email ID of the applicant | 66 |

How to Check PAN Card Correction Status

You can check the status of your PAN card update/correction application online.

- Go to the NSDL PAN website or the UTIITSL website, Where you have applied for correction.

- Navigate to the ‘Know Status of PAN Application’ or ‘Track PAN Card.

- Enter the acknowledgment number and other required details.

- Hit ‘Submit’ to view the status of your PAN card correction application.

The status of the correction application will be displayed on the screen.

FAQs

Is it possible to change PAN card number?

There is no provision to change PAN number online or offline. However, you can update other details mentioned in the PAN card.

Can we apply for a new PAN card number?

Apply for a new Permanent Account Number (PAN) card, changes, or corrections in PAN data through the online form by the Income Tax Department. Users can apply for new PAN card, changes, or corrections in PAN data by selecting the appropriate category of applicants such as individual, firm, company, etc.

How many times can PAN card correction be done?

Once you get your physical card then after 90 days you can again apply for correction. The rest of the process will be the same as the new PAN Card.

How can I convert my old PAN card to new PAN card?

Applicant will fill PAN Change Request Form online and submit the form. The same form will be applicable for citizens as well as non-citizens of India. The applicant will initially select PAN Change Request along with citizenship, category, and title of the applicant and then enter the required details and submit the form.

Can I apply for new PAN if I already have one?

You can submit the application in the form “Request for New PAN Card or/and Changes or Correction in PAN data” in the following cases: When you already have PAN but want a new PAN card, When you want to make some changes or corrections in your existing PAN details.

How much does it cost to get a new PAN card?

PAN Card Apply Price – Fees for Indian Citizens

As an Indian citizen applying for a PAN Card, you need to bear the following fees: For application of New PAN Card fees: ₹101 (including GST) Reprint or changes in existing PAN Card application price: ₹101 (including GST) e-PAN Card application fees: ₹66 (including GST)

Can I surrender my old PAN card?

If you wish to cancel/ surrender your PAN (which you are currently using), then you need to visit your local Income Tax Assessing Officer with a request letter to cancel/ surrender your PAN.

Who can apply for PAN?

All existing assessees or taxpayers or persons who are required to file a return of income, even on behalf of others, must have a PAN. Any person, who intends to enter into economic or financial transactions where quoting PAN is mandatory, must also have a PAN.