Finance Minister Nirmala Sitharaman proposed introducing the NPS Vatsalya Scheme in her Budget 2024 speech. The NPS Vatsalya Scheme enables parents and guardians to start a National Pension Scheme (NPS) for their children.

The Pension Fund Regulatory and Development Authority (PFRDA) manages the National Pension System Vatsalya (NPS Vatsalya) scheme. This scheme extends the National Pension Scheme (NPS) and allows parents to open pension accounts for their minor children.

NPS Vatsalya Registration Link: Click here

NPS Calculator: Click here

We will cover the scheme eligibility, application process, benefits, and applicability.

NPS Vatsalya Scheme Details:

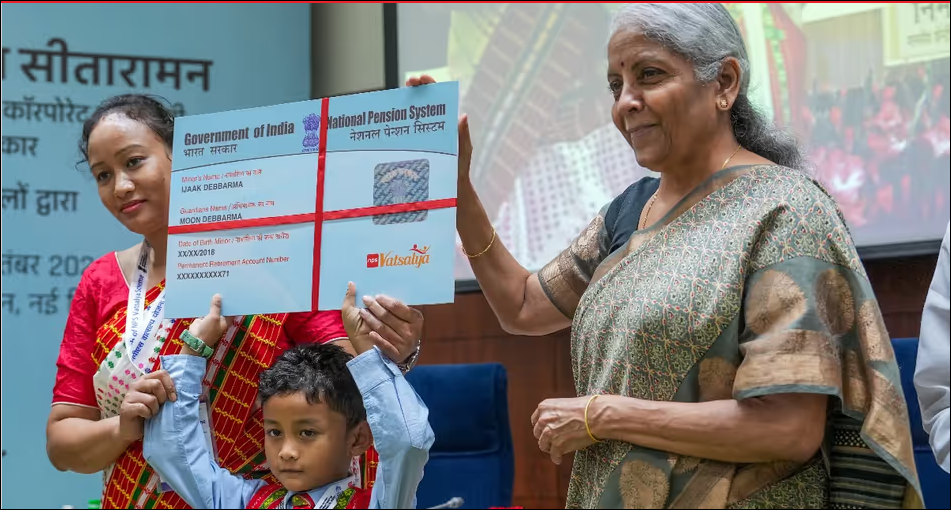

- Finance Minister Nirmala Sitharaman launched the NPS Vatsalya Scheme on 18 September 2024.

- The motive of the scheme is to encourage the empowerment of children with the ultimate objective of creating a pensioned society

- All minor Citizens up to 18 years of age can join the scheme.

- Minimum Contribution for account opening Rs 1000.No limit on maximum contribution.

- After the age of 18 Years seamless conversion into a regular NPS Tier 1 Account (All Citizen).

- There will be fresh KYC of minors within three months, after 18 years of age.

- Upon transitioning, the features, benefits, and exit norms of the NPS Tier I for All Citizen Model will apply.

- Partial Withdrawal reasons can be Education, Treatment of specified illnesses, Disability of more than 75%, or Reasons specified by the PFRDA.

- Exit upon attainment of 18 years – If Accumulated Corpus >= 2.5 Lakh, Min 80% Annuity, up to 20% Lump Sum or If Accumulated Corpus < 2.5 Lakh, up to 100% Lump Sum.

- Exit on account of Death – Death of the minor Entire corpus returned to the Guardian.

- Death of the Guardian Another Guardian to be registered through fresh KYC.

- Death of both parents Legally appointed guardian can continue without making contributions until subscribers attain 18 years of age

| Scheme Name | National Pension System Vatsalya (NPS Vatsalya) |

| Launch Date | 18th September 2024 |

| Launch By | Central Government |

| Department | Pension Fund Regulatory and Development Authority (PFRDA) |

| Target beneficiaries | minor children |

| Objective | The scheme aims to create a pensioned society by encouraging children to save for retirement from a young age. |

| Registration Link | https://enps.nsdl.com/eNPS/NationalPensionSystem.html |

NPS Vatsalya Scheme Documents:

- Date of Birth Proof of Minor

- Aadhaar card of the guardian

- Guardian Signature

- Scanned Copy of Passport (Applicable only for NRI Subscribers)

- Scanned copy of Foreign Address Proof (Applicable only for OCI Subscribers)

- Scanned copy of Bank Proof (Applicable only for NRI/OCI Subscribers)

NPS Vatsalya Scheme Eligibility Criteria:

- Indian citizens below 18 years

- Non-resident Indian (NRI) and Overseas Citizenship of India (OCI) individuals below 18 years

How to Open an NPS Vatsalya Scheme Account?

The process to open NPS Vatsalya Scheme account online is as follows:

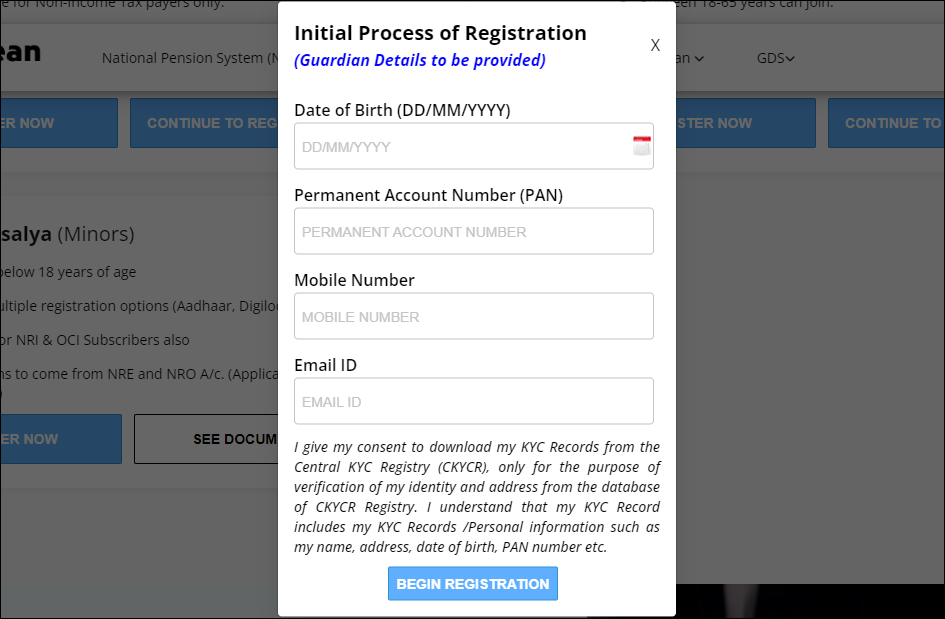

Step 1: Visit the eNPS website.

Step 2: Scroll down and click on the ‘Register Now’ option under the ‘NPS Vatsalya (Minors)’ tab.

Step 3: Enter the guardian’s date of birth, PAN number, mobile number, and email, and click ‘Begin Registration’.

Step 4: Enter the OTP received on the guardian’s mobile number and email.

Step 5: Once the OTP is verified, the acknowledgment number will be generated on the screen. Click on ‘Continue’.

Step 6: Enter the minor’s and guardian’s details, upload the required documents, and click ‘Confirm.’

Step 7: Make the initial contribution of Rs.1,000.

Step 8: The PRAN will be generated and the NPS Vatsalya account will opened in the name of the minor.

NPS Vatsalya Scheme Offline Registration:

- Visit a Point of Presence (PoP): Such as a bank or designated financial institution.

- Submit Forms and Documents: Fill out the NPS Vatsalya form and submit it along with required documents.

NPS Vatsalya Scheme Benefits:

The following are the key benefits of NPS Vatsalya Scheme:

- NPS Vatsalya encourages the habit of saving from an early age.

- The NPS Vatsalya account helps you to build a substantial retirement corpus with early contributions in the NPS account.

- It ensures long-term financial stability by allowing the conversion of the NPS Vatsalya Account to a standard NPS account on attaining maturity and continuing as a reliable retirement fund.

- NPS Vatsalya helps teach children how to manage their finances responsibly from a young age, promoting savings habits as children mature.

- NPS Vatsalya provides you with a structured method to secure your child’s financial future and build a huge retirement corpus.

NPS Vatsalya Scheme: Interest Rate

The interest rate of Mission NPS Vatsalya will depend on the market conditions like other NPS schemes. It might range from 9% to 14% yearly return. This means if you deposit ₨.1000 per month for the next 20 years for your 3-year-old child at an interest rate of 14%, you can expect a return of over ₨.60,00,000 at the end of the term. This makes Mission Vatsalya a great option for long-term savings for your child’s future education or other expenses.

NPS Vatsalya Scheme Calculator:

It is crucial to know the EMI rates and the interest rate so that you can calculate the total amount you’ll receive over time.

This pension calculator illustrates the tentative Pension and Lump Sum amount an NPS subscriber may expect on maturity based on regular monthly contributions, the percentage of corpus reinvested for purchasing annuity, and assumed rates in respect of returns on investment and annuity selected.

NPS Calculator Link: Click Here

NPS Vatsalya Scheme Tax Benefits

At present (till 30-09-2024), There is no tax benefit available for parents under NPS Vatsalya Scheme. The Pension Fund Regulatory and Development Authority (PFRDA) is yet to issue a tax notification for NPS Vatsalya.

Investment Choices Under NPS Vatsalya

The NPS Vatsalya Scheme offers the Default, Auto, and Active investment choices.

- Default Choice: Moderate Lifecycle Fund – LC-50 (50% equity).

- Auto Choice: Aggressive Lifecycle Fund – LC-75 (75% equity), Moderate Lifecycle Fund – LC-50 (50% equity), or Conservative Lifecycle Fund – LC-25 (25% equity).

- Active Choice: Parents can actively decide the allocation of funds across equity (up to 75%), government securities (up to 100%), corporate debt (up to 100%), and alternate assets (up to 5%).

NPS Vatsalya Scheme Partial Withdrawal:

- You can withdraw Up to 25% of your contribution on a declaration basis after the lock-in period of 3 years.

- You can withdraw up to three times till the subscriber attains 18 years of age.

- You can withdraw for the purposes of education, disability of more than 75%, treatment of specified illnesses, etc., as specified by the PFRDA.

Once the child reaches the age of majority (18 years), the NPS Vatsalya Scheme can be converted into a regular NPS account, which can be managed by the child independently. However, the subscriber (minor) must do a fresh KYC within 3 months of turning 18 years old. The accrued contribution amount in the NPS Vatsalya amount will be transferred to the standard NPS account.

NPS Vatsalya Scheme Exit Process:

You can exit if the child doesn’t want to continue or if there is an unfortunate death situation.

IF Child Wants to Close NPS Vatsalya Account:

The child can also choose to exit from the NPS Vatsalya account once he/she turns major instead of converting it to a standard NPS account. Exit upon attainment of 18 years –

- If Accumulated Corpus >= 2.5 Lakh, Min 80% Annuity, up to 20% Lump Sum

- If Accumulated Corpus < 2.5 Lakh, upto 100% Lump Sum

Closing NPS Vatsalya Account in Case of Unfortunate Death:

Exit on account of Death conditions are as follows.

- Death of the minor Entire corpus returned to the Guardian

- Death of the Guardian Another Guardian to be registered through fresh KYC

- Death of both parents Legally appointed guardian can continue without making contributions until subscribers attain 18 years of age

Frequently Asked Questions

1: Is NPS Vatsalya Scheme tax free?

The government has not announced any tax benefits on the NPS Vatsalya Scheme. The Pension Fund Regulatory and Development Authority is yet to announce the taxation aspects of this scheme.

2: Who is eligible for NPS Vatsalya Scheme?

- Indian citizens below 18 years

- Non-resident Indian (NRI) and Overseas Citizenship of India (OCI) individuals below 18 years

3: What is the Vatsalya NPS scheme?

Finance Minister Nirmala Sitharaman proposed introducing the NPS Vatsalya Scheme in her Budget 2024 speech. The NPS Vatsalya Scheme enables parents and guardians to start a National Pension Scheme (NPS) for their children.

4: Where to open NPS Vatsalya Account?

Parents or guardians can open the NPS Vatsalya Scheme on the eNPS website or through Points of Presence (POPs) which include India Post, major banks, Pension Funds, etc.